Global Financial Markets were quite volatile in the first month of 2023. The major headlines were China reopening, Inflation and market movements following YCC tweak by the Bank of Japan. Major global equity markets rose, Treasury yields declined and US Dollar depreciated further after a long bull rally.

Equity Markets

US The US Benchmark S&P 500 rose 6% this month. It opened the year at 3853.29 points and ended last week at 4070.57 increasing by 231 points for this month. The tech heavy NASDAQ 100 index rose 11.21% this month. It opened the year at 11038.42 points and ended the week at 12166.60 points rising by around 1227 points for the month.

Australia The Australian benchmark ASX 200 index rose 6.47% this month. It opened the year at 7038.7 points and ended last week at 7493.8 rising by 455 points for the month.

UK The UK benchmark FTSE 100 index rose 4.21% this month. It opened the year at 7451.74 points and ended last week at 7765.14 rising by 313 points for the month.

Mainland China The Chinese benchmark CSI 100 index rose 9.22% this month. It opened the year at 3728.9 points and ended last week at 4079.3 rising about 345 points for the month.

Hong Kong SAR The Hong Kong benchmark HANG SENG:HSI index rose 14.70% this month on the good news of reopening of China. It opened the year at 19570.4 points and ended last week at 22688.9 points rising by around 2907.5 points for the month.

Japan The Japanese benchmark NIKKEI 225 index rose 4.94% this month. It opened the year at 25834.93 points and ended last week at 27382.49 points rising by 1288 points for the month.

Singapore Singapore’s benchmark STI index rose 4.39% this month. It opened the year at 3243.99 points and ended last week at 3394.22 points rising by around 143 points for the month of Jan 2023.

India The Indian benchmark index dropped 2.77% this month. It opened the year at 18131.70 points and ended last week at 17604.35 falling by around 501 points for the month. The major highlight of the month was the fierce fall of Adani Stocks after Hindenburg Research reported stock manipulations and accounting fraud.

Commodity Markets

Gold The US Dollar Gold Spot index rose 5.7% this month. The spot gold price started this month at 1823.79 US$ per ounce and rose 103.94 US$ per ounce to trade at 1927.73 US$ per ounce as of latest reading on Saturday. Analysts project the gold price to remain at these highly elevated prices due to inflation and global economic uncertainty as Gold is viewed as a safe haven commodity in the global financial market.

WTI Crude The WTI Crude futures contract expiring on March 2023 declined 1.31% this month. The futures contract started trading this month at 80.54 per barrel and fell 1.05 dollar per barrel to stand at 79.36 per barrel. It remains volatile as Prices can be impacted positively due to the boost in demand from China reopening while at the same time can be negatively impacted because of the slowing global economy due to contractionary monetary policies implemented by most of the central banks around the world to combat decade high inflation.

Brent The ICE Brent Crude futures contract expiring on March 2023 remained flat at around 86 dollars per barrel

Natural Gas The NYMEX Natural Gas futures contract expiring on Feb′23 declined around 35% this month. It started the month at 4.137 and fell 1.543 to close at 2.855. Natural Gas had previously rose to very high levels after the supply was disrupted by Russia in Europe and the subsequent fears of a severe winter in the Western Hemisphere. Fortunately, the winter was quite mild which led to the price dropping due to the lesser demand than previously anticipated.

Currency Market

EUR USD The Euro appreciated against the US Dollar by 1.55% this month. The EURUSD started the month at 1.06994 and rose 0.01663 to end the month at 1.08657.

GBP USD The Great British Pound appreciated against the US Dollar by 2.50% this month. The GBPUSD started the month at 1.20857 and rose 0.03023 to end the month at 1.23880.

USD CHF The US Dollar appreciated against the Swiss Franc by 0.37% this month. The USDCHF started the month at 0.92415 and declined 0.00346 to end the month at 0.92069.

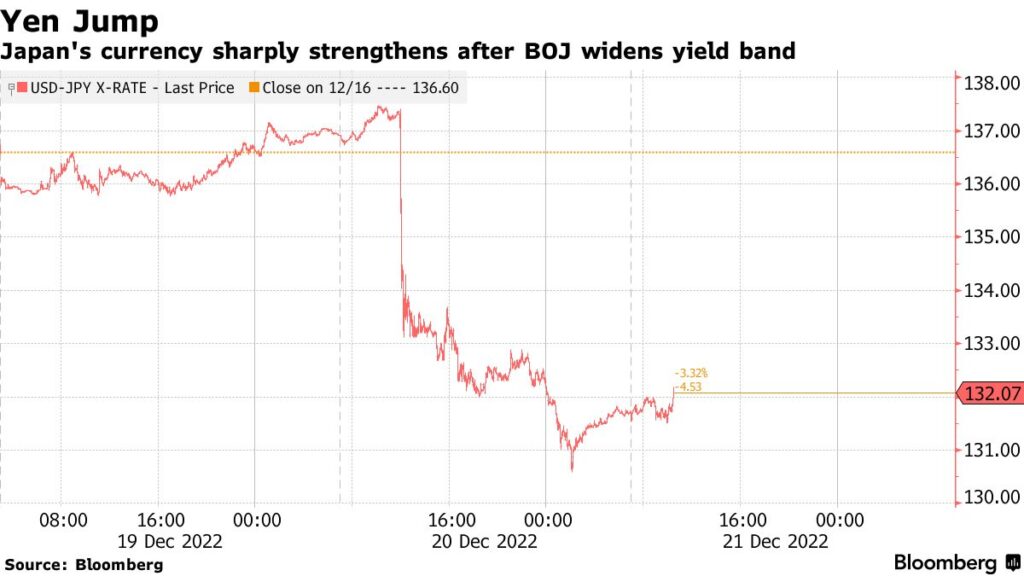

JPY USD The Japanese Yen appreciated against the US Dollar by 0.98% this month. The JPYUSD started the month at 0.007623 and increased 0.000075 to end the month at 0.007699. The Japanese Yen which touched the record level of 0.00672 last October had started strengthening after the Bank of Japan raised the YCC target from 0-0.25% to 0.25%-0.50%. Since its bottom it has risen around 20% in about 3 months.

Source: Bloomberg, 21 December 2022

AUD USD The Australian Dollar appreciated against the US Dollar by 4.28% this month. The AUDUSD started the month at 0.68146 and rose 0.02916 to end the month at 0.71062. The Australian Dollar strengthened after ABS reported rise in inflation prompting the RBA to hike cash rate even further up.

AUD NZD The Australian Dollar appreciated against the New Zealand Dollar by 2.03% this month. The AUDNZD started the month at 1.07275 and rose 0.02174 to end the month at 1.09449.

Fixed Income Markets

US Treasuries The United States Government Bonds 2 year yield declined 5.08% this month and is currently at 4.203% p.a.. Similarly the 10 year yield declined 9.66% this month and is currently at 3.505% p.a. At the longer time horizon, the 30 year yield declined 8.86% this month and is currently at 3.623%. The yield curve is still inverted with the 2/10year treasury spread at negative 58 basis points. Historically the inversion of the yield curve have been seen as a powerful predicator of the recession in the US economy. This time its accuracy will be highly tested again because a growing consensus have been building up about a possible soft landing.

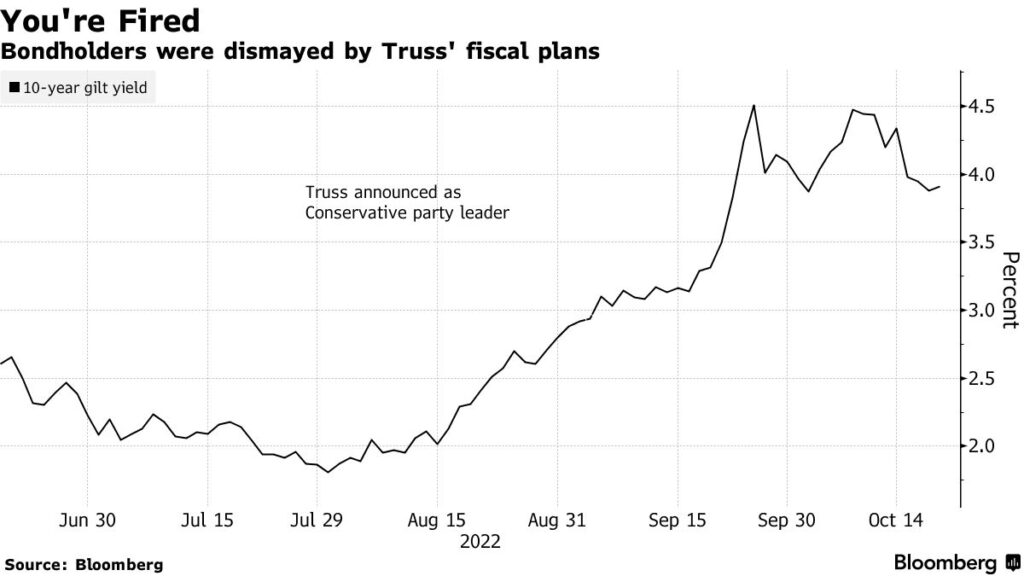

UK GILTs The United Kingdom Government Bonds 2 year yield declined 6.20% this month and is currently at 3.477% p.a.. Similarly the 10 year yield declined 9.29% this month and is currently at 3.328% p.a. At the longer time horizon, the 30 year yield declined 6.73% this month and is currently at 3.688%. The 10 year GILTs touched a record high yield of 4.63% last October when the bond markets were rattled by a market selloff due to the Controversial Mini Budget proposed by the former Chancellor of the Exchequer Kwasi Kwarteng under the leadership of Former UK Prime Minister Liz Truss.

Source: Bloomberg, 20 October 2022

Japan JGBs The Japanese Government 10 year Bonds currently yields 0.481%. This bond yield touched a 8 year high of 0.59% this month after the BOJ announced the shocking changes to the Yield Curve Control (YCC) measures. Currently, the Bank of Japan targets to keep this bond yield between the target range of 0.25% to 0.50%.

News Highlights of the month

- Croatia joins Eurozone on Jan 1 after years of preparation. With it, Croatia becomes the 20th nation to accept Euro as its official currency.

- China re opens after almost 3 years of lockdown and severe zero COVID policy

- Pakistan’s central bank SBP increased benchmark repo rate on Jan 23 to 17% due to mounting inflation

- Pakistan’s economy seems in freefall as its country’s currency relative to the US dollar declines about 10% in two days

- Tensions rise after US Treasury approaches the Debt ceiling limit and Treasury Secretary Janet Yellen implements extraordinary measures to avoid catastrophe

- Australia’s inflation rose to the highest levels since March 1990

- Fed’s preferred measure Core PCE Inflation declines to 5.02% year on year

Major Events of Next Month

- US Fed FOMC is expected to increase the fed funds rate target by 25 basis points on the first of February

- European Central Bank is expected to raise the benchmark interest rate in the eurozone by 50 basis points on the 2nd of February

- Reserve Bank of Australia is expected to raise RBA Cash rate target by 25 basis points on 7th of February

Note: All the market data are extracted from Trading View. The Author does not take full responsibility of the accuracy of the data. This information is solely for education purposes and None of the information should be taken as an Investment advice.