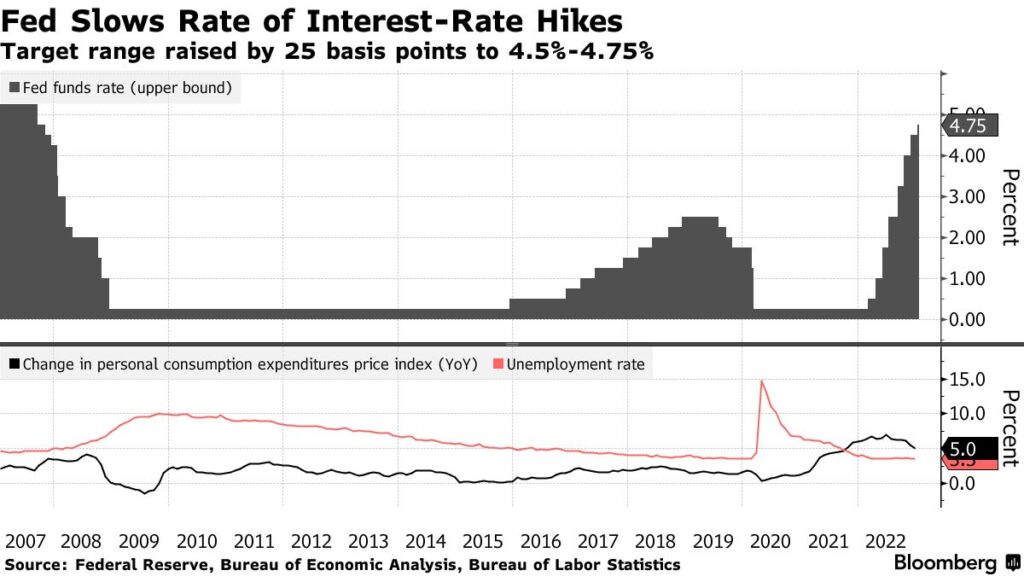

The Federal Open Market Committee (FOMC) of Federal Reserve Board has increased the target range for the Federal Funds rate to 4.5% to 4.75%. This comes after the fed’s favoured measure of inflation i.e. Core PCE price index fell to 4.4% in December from the year before. The Commerce department released the inflation readings last Friday and as a result fed was seen less hawkish in the latest meeting on monetary policy. Speaking at the press conference, Chairman Powell mentioned that they’ve raised the funds rates four and a half percentage points so far in this hiking cycle and that they’re talking about a couple of more rate hikes to get to the level that the committee thinks is appropriately restrictive enough to get back inflation to target.

The committee emphasized that its job is not yet done and they are still highly attentive to the inflationary risks specially in the service sector. The Fed whose job is to achieve maximum employment and stable prices uses inflation target of 2% average inflation annually in the long run. The committee also communicated that the ongoing increases in the funds rate will be appropriate to bring the inflation down to its target range and mentioned that the future rate increases will be determined by the incoming data and they would be taking it meeting by meeting. The fed mentions in its press release that it is aware of the lags in which monetary policy operates but doesn’t want to risk doing too less.

The Great Inflation of 1960s had given Central banks around the world a huge lesson that doing too less would be a catastrophe as hiking too little would lead to entrenched inflation expectations into the household and business decisions making and this would lead to higher cost for the economy in the future as the central bank would have to hike rates even higher if they are late in responding to these inflationary pressures. As a result, the committee does not want to prematurely halt hiking rates before seeing substantial fall in inflation towards the target range of 2%. The fed also communicates that future increases will be depended on future developments regarding the effects of past rate hikes, evolving financial and economics developments. The committee notes that it will significantly reduce its holding of Treasury securities and agency debt and agency MBS.

To implement the decisions regarding the monetary policy the fed will make the following arrangements:

- The FOMC authorizes and directs the Open Market Desk at the Federal Reserve Bank of New York to execute transactions in accordance with its domestic policy directive

- The FOMC directs the desk to undertake open market operations as necessary to maintain the fed funds rate in the target range of 4.5% to 4.75%

- The Committee directs to conduct overnight repo at a minimum bid rate of 4.75% and with an aggregate operation limit of $550 billion with the option to temporarily increase the limit at the discretion of the Chair

- The Committee directs to conduct overnight reverse repo at an offering rate of 4.55% and with a counterparty limit of $160 billion with the option to temporarily increase the counterparty limit at the discretion of the Chair

- The FOMC directs to roll over at auction the amount of principal payments from the Federal Reserve’s holding of Treasury securities which are maturing in each calendar month that exceeds a cap of $60 billion per month

- The FOMC directs to reinvest the agency MBS the amount of principal payments from the Fed’s holding of agency debt and agency MBS received in each calendar month that exceeds a cap of $35 billion per month

- The FOMC directs to engage in dollar roll and coupon swap transactions as required for facilitating the settlement of the Fed’s agency MBS transactions

The next meeting of the Federal Open Market Committee (FOMC) will be on March 21-22.

Source: https://www.federalreserve.gov/newsevents/pressreleases/monetary20230201a.htm