Today the monetary policy board of the Bank of Korea left the Base rate unchanged at 3.5%. This rate is the key benchmark rate which influences all kinds of other market interest rates in South Korea.

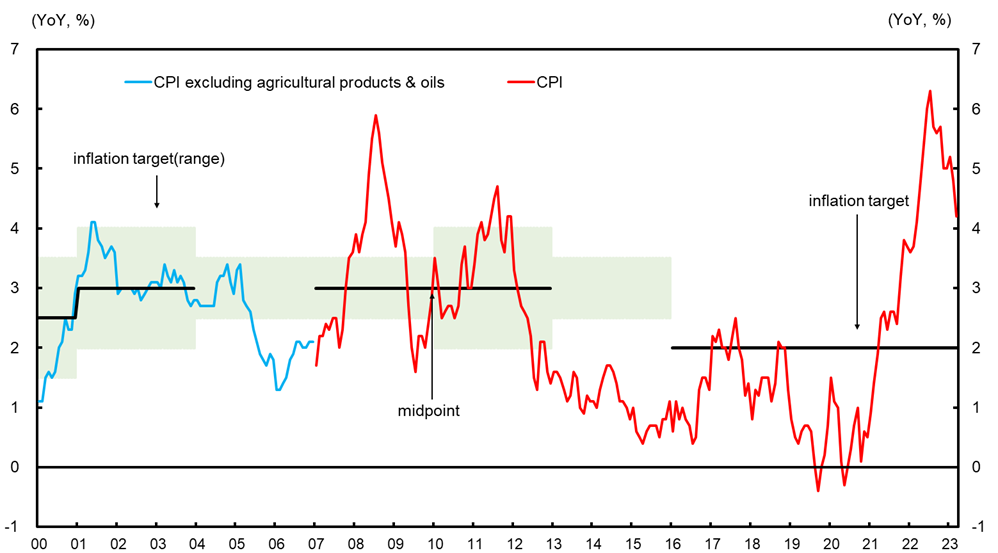

The Bank of Korea adopts an Inflation targeting monetary policy framework. Under this, it tries to keep the inflation measured by the Consumer Price Index (CPI) at 2% year on year in the medium term. The latest inflation print of March showed the annual price increase at 4.2% which is well above the target of 2%. But the good thing for the monetary authority was that inflation was actually moderating to the downside as the February CPI stood at 4.8%. The central bank forecasts this year’s inflation to be around 3.5%.

Bank of Korea’s Inflation Target & Actual Inflation 2000-2023

For the purpose of deciding on the monetary policy, the Board meets eight (8) times in a year and determine the key reference policy rate by taking into account all kinds of internal and external economic, financial and price conditions. The Base rate works in the South Korean economy through the channel of Banking and Financial institutions where this rate impacts the overnight inter bank lending rate thus impacting and changing the short and long term funding rates in the Korean economy.

Source: Bank of Korea (BOK)

Official Monetary Policy Decision Press Release