The Federal Reserve Board (Central Bank of USA) increased the federal funds rate by 25 basis points or 0.25% in the July Federal Open Market Committee (FOMC) meeting taking the target fed funds rate from 5.00-5.25% range to 5.25-5.50% range.

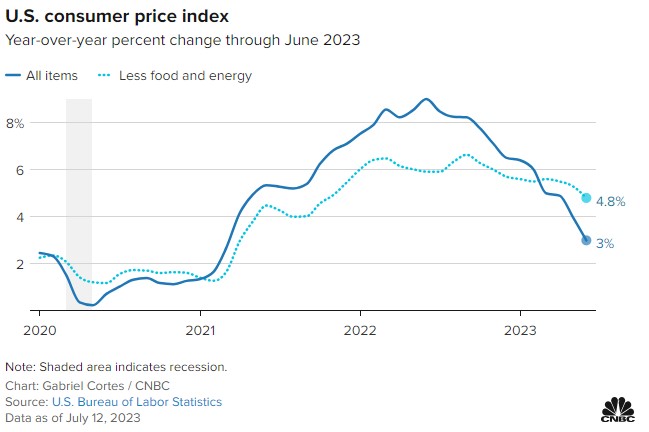

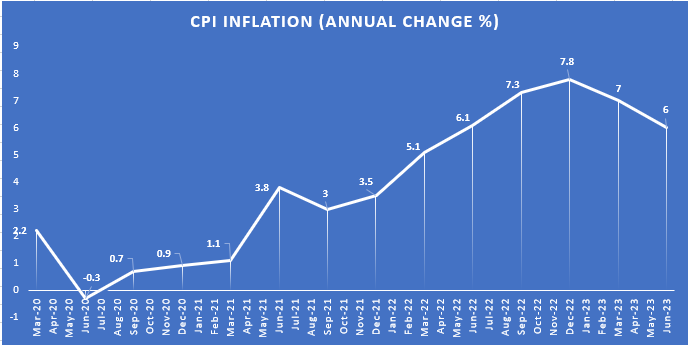

This came as a no surprise as market analysts and economists had already expected his decision. As a result, most of the financial markets had already priced in the rate hike. Although the hike was already priced in but everyone were looking at how the tone and communication of the Fed would be moving forward and what kind of forward guidance if any would be provided by the committee. The committee mentioned that they will be highly data dependent moving ahead and assess a wide range of information and metrics like condition of the labor market, inflation pressures and expectations, financial market conditions and international developments. The June 2023 Core CPI inflation in the United States was 4.8% from a year ago and rose 0.2% on a monthly basis. However, the headline inflation dropped to just 3% giving the policy makers a big relief as it was 9% just a year ago on June 2022.

The next day on July 27, the European Central Bank (ECB) followed the similar path by raising its three key interest rates by 25 basis points. As per the decision of the Governing Council, the interest rate on the main refinancing operations, marginal lending facility and the deposit facility will be increased to 4.25%, 4.50% and 3.75% respectively, with effect from 2 August 2023.

Although inflation continues to decline in the eurozone but it’s still well above the medium term target level of 2% . The June 2023 inflation rate stands at 5.5% which fell from the 6.1% reading of May 2023. The ECB Governing Council on the monetary policy decision press release conveyed that the future interest rate decisions will continue to follow a data dependent approach and will be based on its assessment of the inflation outlook in view of the incoming economic and financial data, the inflation dynamics , and the strength of the monetary policy transmission.

Meanwhile in Australia, the Reserve Bank of Australia left the official cash rate target unchanged at 4.1% in its August Monetary Policy Committee meeting. This came after a softer than expected inflation print in the June quarter followed by slowing economic activity and falling retail sales.

Sources:

Federal Reserve FOMC Statement: https://www.federalreserve.gov/newsevents/pressreleases/monetary20230726a.htm

ECB Monetary Policy Press Release: https://www.ecb.europa.eu/press/pr/date/2023/html/ecb.mp230727~da80cfcf24.en.html

RBA Monetary Policy Statement: https://www.rba.gov.au/publications/smp/2023/aug/