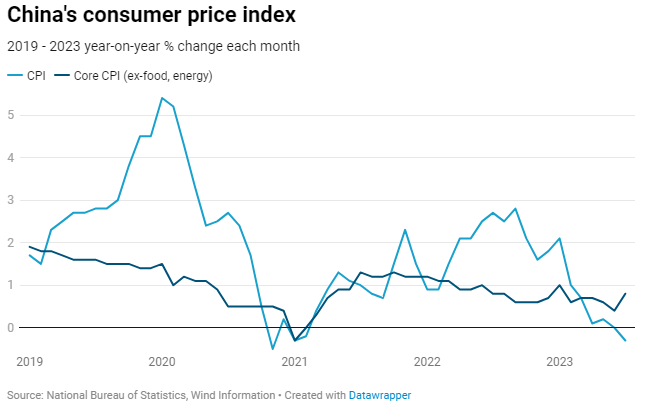

China’s Consumer Price Index (CPI) fell by 0.3% last month in comparison to a year ago. This comes after the Chinese economy was already gripping from slower consumption and issues in the property market further accelerating serious concerns about the Chinese economy. The People’s Bank of China was already decreasing interests rate since a while and boosting liquidity to support the lagging Chinese economy while the FED and other advanced economies Central Banks were aggressively hiking the interest rates to combat soaring inflation in their respective economies.

While the most of the rest of the world is facing a high inflationary environment, it’s interesting to see China falling into deflation. The National Bureau of Statistics of China officials reported on Wednesday that this decrease in general price levels is due to the base effects of last year and they see inflation going up gradually. Financial Reporters and Analysts are skeptic that Chinese officials are trying to hid the fact that China has fallen into deflationary environment as this is likely to impact Consumer decision making going forward which may likely further exacerbate the deflationary expectations.

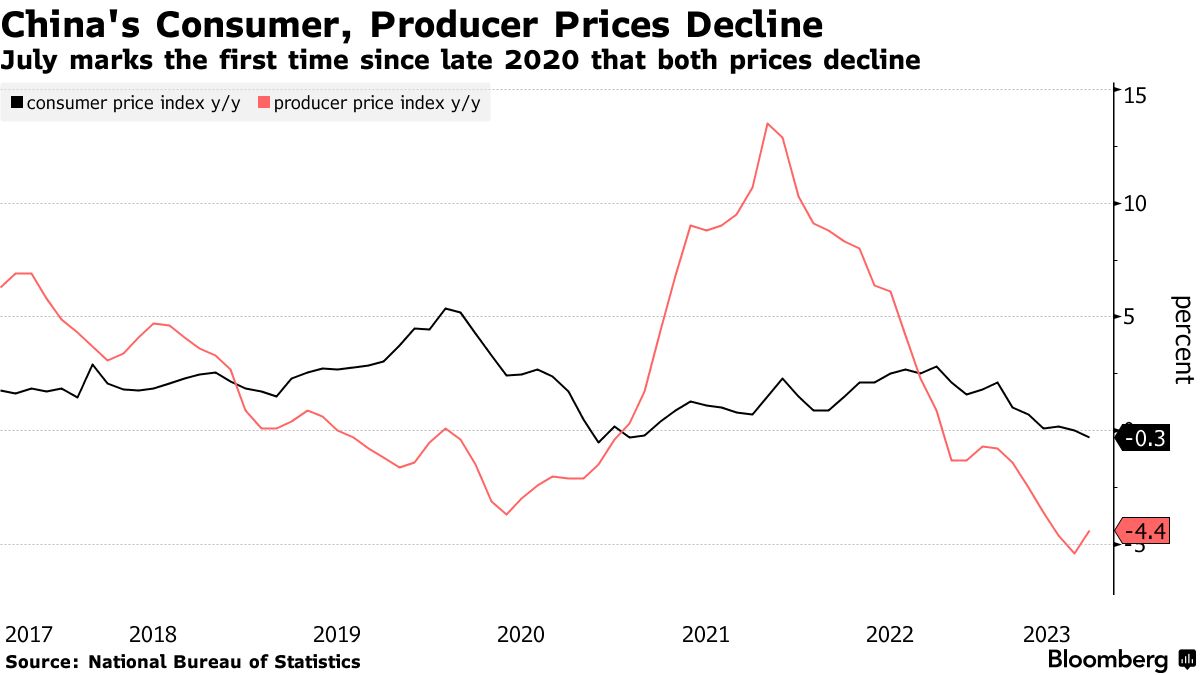

This comes after China’s Producer Prices contracted by 4.4% from a year earlier in July. On Tuesday, China reported that its exports fell by 14.5% in July from a year earlier and its imports fell by 12.4% in dollar terms. Particularly, its exports to the United States and European Union fell by 23.1% and 20.6% y/y in July respectively.

This kind of descend in the Chinese economy is adding to the growth misery of the global economy. As China is the second largest economy and one of the biggest market of the world so weakness in China likely impacts the global economy. The International Monetary Fund (IMF) has forecasted China to be the biggest contributor of the global growth for the next five years representing almost 23% of the total world growth and this economic issues in China surely won’t help the global economy to grow as forecasted.

Monetary Authorities around the world fear deflation more than Inflation because once Deflation gets into the consumer expectations then it will be very hard to get the economy into inflation again. This is why almost all of the Central Banks around the world have a clearly defined inflation target regime in the fears that if the inflation approaches near to zero then it could leading to the economy falling into deflation.

Japan’s economy is a prime example why Policymakers fear deflation. Conventional Monetary Policy of further decreasing the interest rates to boost borrowing and hence economic activity becomes less useful once the interest rates reach near zero or the effective lower bound. As a result of deflation, consumer start postponing their consumption and this leads to further downfall of consumption and aggregate demand thus leading to lower prices. This then forms a vicious cycle where the economic growth falls and unemployment levels rise leading to widespread economic woes. Although the current deflation in China could be a temporary hiccup for the economy but it will certainly make the policymakers strongly rethink about the trajectory they are heading.