The Reserve Bank of Australia i.e. Australia’s Central Bank has finally decreased the official Cash Rate from 4.35% to 4.10%. The cash rate deduction represents a cut by 25 basis points or a quarter of a percentage points. This is the first time the central bank reduced its benchmark interest rate after November 2020 when it was reduced to the lowest level of 0.10% due to the significant economic fallout caused by the COVID-19 pandemic.

The Bank’s Monetary Policy Board decided today to reduce the rate which represents its effort to change its restrictionary monetary policy stance to a more neutral level. This came after Inflation in Australia seemed to come down gradually to its target range. RBA follows the inflation targeting framework for its price stability mandate and aims to keep the inflation rate between 2-3% target range.

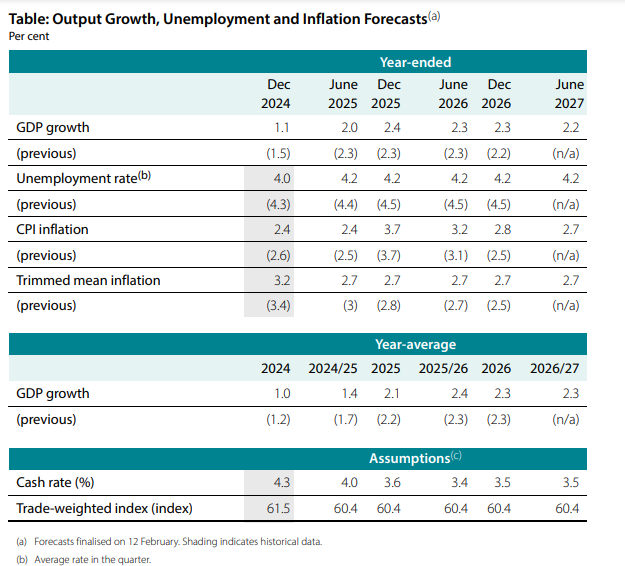

However, the forecasts in the detailed Monetary Policy Statement shows that inflation is likely to rise again after June 2025. This could be a result of expiry of the current electricity bill rebates of the Albanese Government. As a result, the forecasts shows that rates are not going down drastically. The Bank sees the cash rate at the elevated levels of around 3.5% throughtout to June 2027 which is higher compared to historical averages.

Sources:

https://www.rba.gov.au/publications/smp/2025/feb/pdf/statement-on-monetary-policy-2025-02.pdf

https://www.rba.gov.au/monetary-policy/