The US Federal Reserve FOMC has left the funds rate unchanged at 4.25% – 4.50% range. As per the press release of the March 18-19, FOMC assessed that the “Inflation remains somewhat elevated” and has emphasized that the “Uncertainty around the economic outlook has increased”. Speaking at the Press Conference, Chair Powell acknowledged that inflation in the short run is starting to move up partly in response to tariffs and Short term inflation expectations have increased, but long term inflation expectations remain well anchored. He also mentioned the focus on separating the signal from the noise. The term “Transitory” inflation is expected to be the baseline forecast.

FOMC Median Economic Projections:

|

Variables |

2025 |

2026 | 2027 |

| Real GDP Growth |

1.7 |

1.8 |

1.8 |

| Unemployment Rate |

4.4 |

4.3 |

4.3 |

| Core PCE Inflation |

2.8 |

2.2 |

2.0 |

|

Fed Funds Rate |

3.9 | 3.4 | 3.1 |

Source: Summary of Economic Projections, March 19,2025 ; Federal Reserve Board

Real GDP Growth:

2025 Real GDP growth projection down from 2.1% to 1.7% (Board thinks growth will slow down due to economic uncertainty i.e. trump tariffs). The median projections for the Real GDP growth for the year 2026 and 2027 has been downgraded to 1.8% and 1.8% from December 2024 projection of 2% and 1.9% respectively.

The longer run real GDP grown projection has been downgraded from 1.7-2.5 % range to 1.5-2.5 % range clearing articulating slowing longer run growth rates

Unemployment Rate:

2025 unemployment rate has been projected at 4.4% which is a 0.1% increase from the December 2024 projection of 4.3%. Slowing economic growth is likely to mildly increase the unemployment rate. The long run unemployment rate projection for the US economy ranges from 3.5% – 4.5%.

PCE and Core Inflation:

As widely anticipated by the economic community, The PCE inflation is projected to increase to 2.7% from the December projection of 2.5%. On December 2024, the committee’s projection ranged from 2.1-2.9 % which is now increased to 2.5-3.4 % for 2025. The committee projects the PCE inflation to remain at 2% which is their inflation target over the medium term.

Similarly, Core PCE inflation is predicted to increase to 2.8% from 2.5% December projection.

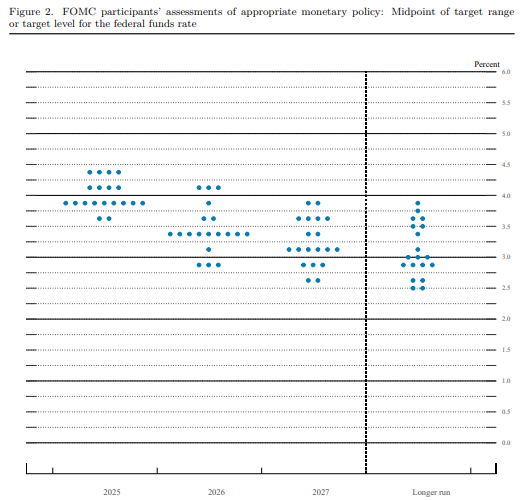

Fed Funds Rate Projections:

The Committee projects the Federal Funds rate for 2025 at 3.9% which is same as of Dec. 2024 projection. This implies the fed funds rate target of 3.75% to 4.0%. Looking at this, the committee predicts it might be appropriate to cut the funds rate two times later this year each of 25 basis point which will bring the current level of 4.25%-4.5% range down to the projected range. The projection of central tendency for the fed funds rate for 2025 is increased to 3.9-4.4 from the Dec. 2024 projection of 3.6-4.1. The projected range for the fed funds rate for 2025 is also increased to 3.6-4.4 from the Dec. 2024 projection of 3.1-4.4.

Source: FOMC Dot Plot, SEPs, Federal Reserve Board

The Federal funds rate is projected at 3.4% and 3.1% for 2026 and 2027 respectively.

The increases in projection shows that more members of the committee are skeptical and hawkish regarding the economic policies of the incoming Trump administration which is likely to increase the US inflation at least in the short run which might require current level of restricted monetary policy.

Recently, the University of Michigan Survey showed that the US consumer sentiment have fell from the level of 64.7 in February to 57.9 in March 2025.

Sources:

https://www.federalreserve.gov/newsevents/pressreleases/monetary20250319a.htm

https://www.federalreserve.gov/newsevents/pressreleases/monetary20250319b.htm

https://www.federalreserve.gov/monetarypolicy/files/fomcprojtabl20250319.pdf

https://www.federalreserve.gov/monetarypolicy.htm

http://www.sca.isr.umich.edu/