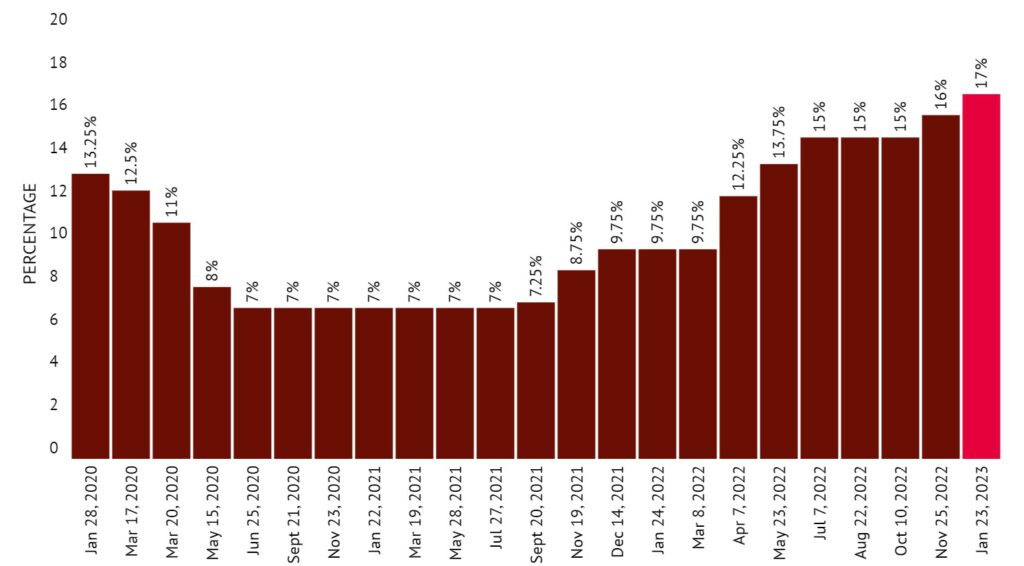

Pakistan’s central bank State Bank of Pakistan has hiked its benchmark SBP target rate for the overnight repo rate to a 24 year high of 17%. The Monetary Policy Committee increased the rate by 100 basis points to 17% on Jan 23 to combat the inflationary pressures and economic issues. According to a survey conducted by Reuters, 14 out of 22 economists and market watchers predicted the 100 basis point hike by the central bank.

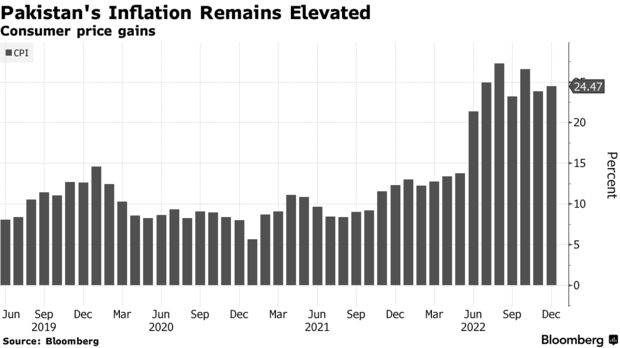

This comes after the annual inflation rose to 24.47% while the mid term inflation target of the bank is between 5% to 7%. The Monetary Policy Committee (MPC) highlighted that the 100 basis points hike was inevitable to combat the inflation and to make sure that the price stability objective is not compromised and avoid entrenchment of the higher inflation expectations in the economy.

SBP have hiked the rate 725 basis points on one year and this has significantly tightened the financial conditions and economic activities. High inflation, Supply imbalances and depletion of foreign currency reserves have made the situation worse. The recent data shows that the currency reserve is so low and critical that it is sufficient just to import for less than a month. To add misery in the economic turmoil, decreasing capital flows and elevated level of debt repayments have fuelled the crisis. Last year Pakistan faced a huge flooding and a subsequent political turmoil.

However, Pakistan expects funding from International Monetary Fund (IMF) and other partners of the Middle East. Hiking the price of Fuel is one of the condition of IMF. Despite that growing fear of global recession and downfall of growth is likely to impacts country’s exports and remittance in the time to follow. Analysts and Economists suspect that the SBP is keeping exchange rate at an impractical level which has become the reason for decreasing remittance in the country.

The Monetary Policy Committee suspects that there is policy divergence as the fiscal policies are not cooperated with the monetary tightening goal of the central bank to address the prevailing macroeconomic challenges. Although current account deficit has narrowed recently due to the tightening of the bank and various other administrative policy changes impacting the imports but is still at the elevated level.

The next meeting date of the Monetary Policy Committee of the central bank is on Thursday, March 16, 2023