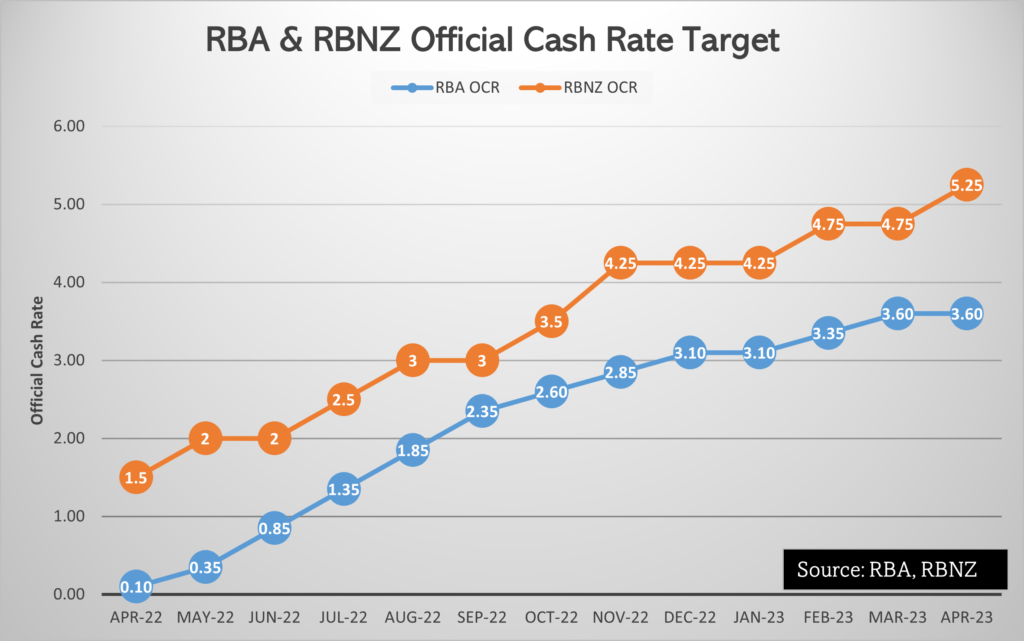

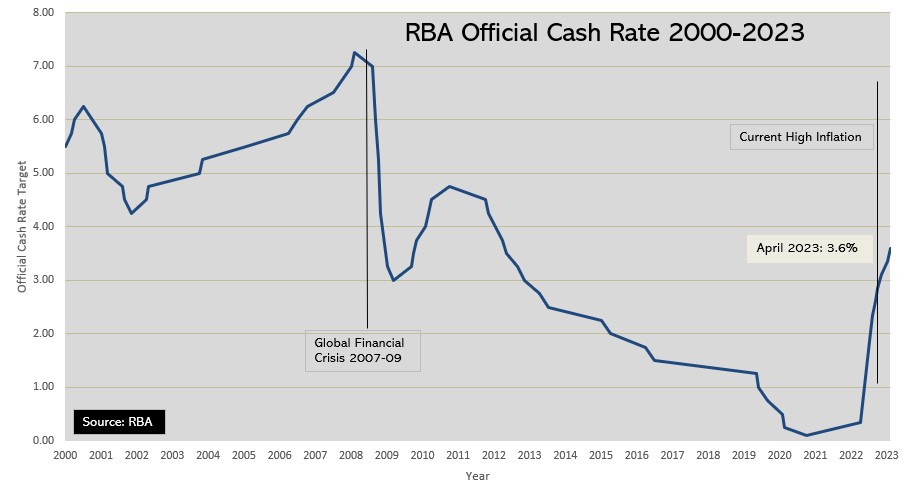

This week at the Reserve Bank of Australia’s Monetary Policy meeting the board decided to pause the current interest rate hikes and left the Official Cash Rate (OCR) on hold at 3.6% while the Reserve Bank of New Zealand surprised everyone with a 50 basis points hike to take the OCR from 4.75% to 5.25%.

The latest CPI inflation figure in New Zealand stood at 7.2% y/y while that in Australia as per the February 2023 monthly indicator stood at 6.8%. Inflation has moderated in Australia but New Zealand stills lags behind in it.

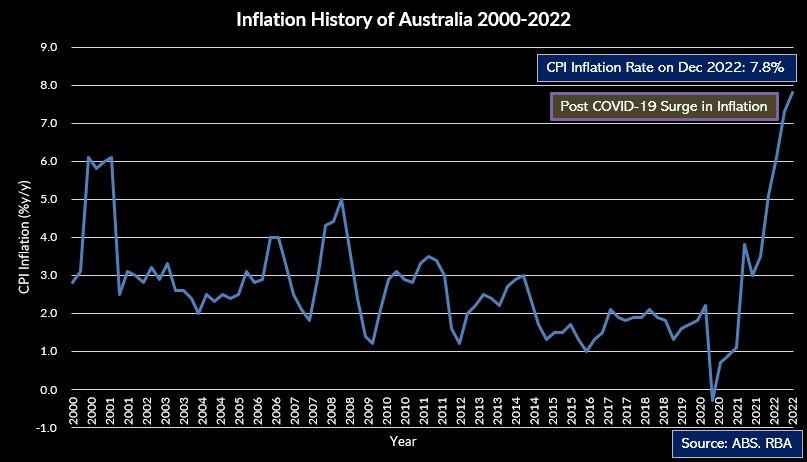

Australia: Inflation and RBA OCR

Australia used to publish inflation data only on a quarterly basis but since 2022 it has started to publish inflation on a monthly basis as well. As per the latest quarterly reading, The peak 7.8% y/y CPI inflation print of Dec 2022 was the highest inflation recorded since May 1990. Among the basket of goods and services that compose the inflation reading, Annual housing price rose 10.7% which is the highest price rise among all the items in the CPI basket. Housing comprises the highest portion of family expenditure in Australia hence it is the most heavy weighted item of the CPI measurement. Australia risks more increases in the interest rates due to the tight rental and property market due to the heavy influx of immigrants and international students after the COVID-19 pandemic induced lockdowns.

In the latest April Monetary Policy Statement, Governor Lowe noted that the board expects a further monetary tightening to bring the inflation back to the 2-3% target and mentioned that the decision to hold the cash rate at the current level is to buy more time to assess the impact of past rate rises in the Australian economy. Most of the market participants had already priced in this decision to hold interest rates as many firms including CBA and AMP had forecasted that RBA would pause going into the April meeting.

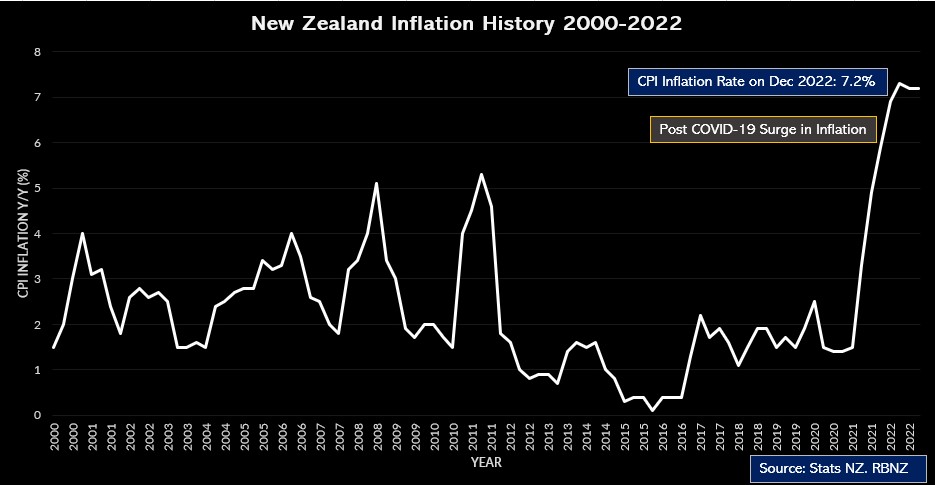

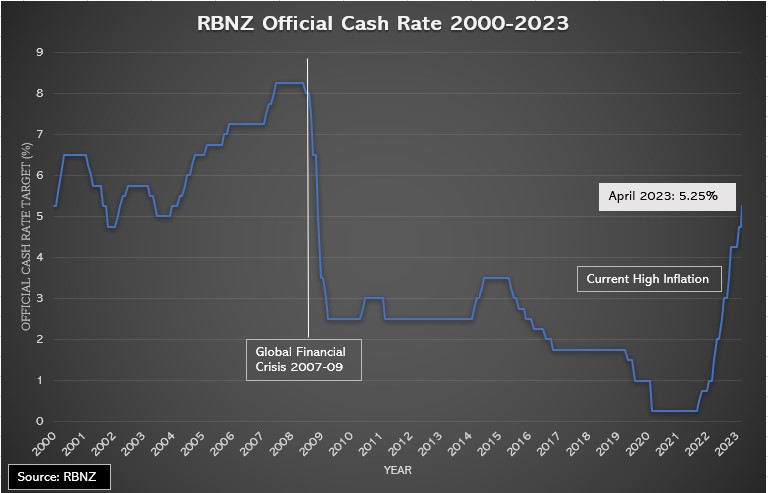

New Zealand: Inflation and RBNZ OCR

The latest inflation print of New Zealand showed that the annual headline inflation rose to 7.2% year on year which is the highest inflation reading since June 1990. The Reserve Bank of New Zealand executes the monetary policy to achieve an inflation target between 1% to 3%.

Hence to combat this ultra high inflation it started increasing interest rates since October 2021 when it hiked the official cash rate from 0.25% to 0.50%. Currently this rate stands at 5.25% and the Reserve Bank of New Zealand is expected to hike one more time by 25 basis points before holding the cash rate at 5.5%.