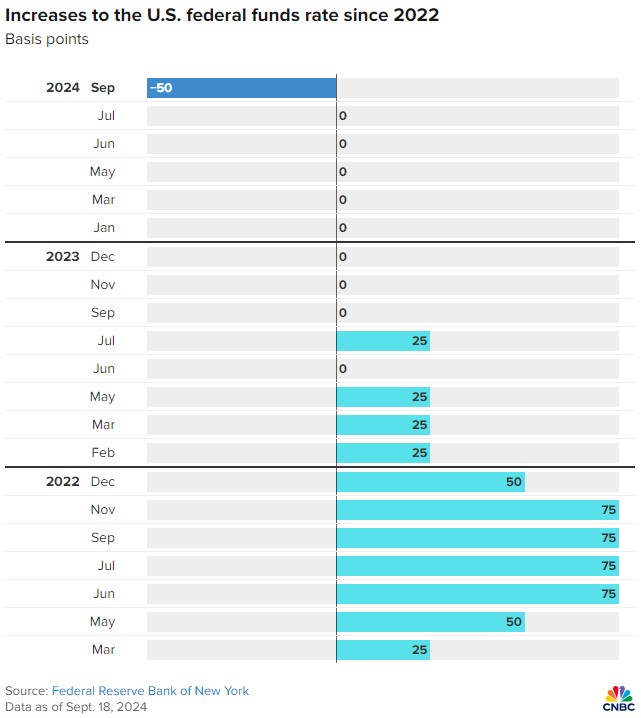

The Federal Open Market Committee (FOMC) of Federal Reserve Board has decreased the target range for the Federal Funds rate by 50 basis points. This decision to lower the target range for the federal funds rate by 1/2 percentage point brings the Federal funds rate to the level of 4.75 percent to 5 percent. This is the first time the federal reserve decreased the funds rate after March 2020 during the Covid-19 pandemic. 11 out of 12 board members voted for a half percentage cut. Fed Governor Michelle W. Bowman voted against the half percentage point and preferred a 25 basis point.

The Current hiking cycle which started from March 2022 to July 2023 seem to have ended with the Inflation back to the 2-3% range which has seem to made the Board confident that the prices have come to the comfortable levels and the inflation expectations are now well anchored. As the US unemployment level has significantly rose over the past couple of months, the Fed now seems more focused on preventing further deterioration in the labor market.

The Federal Reserve Board (Also called as The Fed) is the Central Bank of the United States of America and conducts Monetary Policy in the US. Fed guides its monetary policy on the policy stance of dual mandate of keeping stable prices and promoting maximum employment. To achieve its objective, it controls the three tools of monetary policy namely Open Market Operation, the Discount Rate and Reserve Requirements.

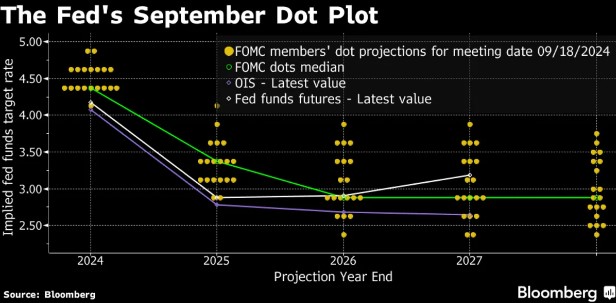

The Fed also released the Summary of Economic Projections(SEP) in the September FOMC meeting. As per the dot plot, the FOMC is expecting that the feds fund rate will end the year around 4.4% which indicates the target range of 4.25% to 4.50%. Given there are two meeting remaining before the end of 2024, two rate cuts of 25 basis points each looks on the table. But, The Fed Chair Jerome Powell reiterated that these figures are projections are estimates only and likely to change according to incoming economic data. The central message was that they are data dependent and ready to make changes to manage the balance of risks on the both sides of their dual mandate of promoting stable prices and maximum employment.

References:

Fed Press Release: https://www.federalreserve.gov/monetarypolicy/files/monetary20240918a1.pdf

About the FOMC: https://www.federalreserve.gov/monetarypolicy/fomc.htm

Fed SEP: https://www.federalreserve.gov/monetarypolicy/files/fomcprojtabl20240918.pdf

Bloomberg Article: https://www.bloomberg.com/news/articles/2024-09-18/fed-cuts-rates-by-half-point-in-decisive-bid-to-defend-economy

CNBC Article: https://www.cnbc.com/2024/09/18/fed-cuts-rates-september-2024-.html